Presentation Transcripts

Latest Update : June 6, 2023

Back to Financial Results (FY3/2023)

Investor Meeting Presentation for FY 3/2023 held on May 11, 2023

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales, Operating Income / Margin

- Increase / Decrease & Special Factors of Full Year OP

- Net Sales, Operating Income / Margin

- Improvement of Understandability by Changing Segment Names

- 4Q Actual: Differences from the Forecast as of February

- Machined Components / Precision Technologies (PT) Year

- Machined Components / Precision Technologies (PT) Quarter

- Electronic Devices & Components / Motor, Lighting & Sensing (MLS) Year

- Electronic Devices & Components / Motor, Lighting & Sensing (MLS) Quarter

- MITSUMI Business / Semiconductors & Electronics (SE) Year

- MITSUMI Business / Semiconductors & Electronics (SE) Quarter

- U-Shin Business / Access Solutions (AS) Year

- U-Shin Business / Access Solutions (AS) Quarter

- Profit Attributable to Owners of the Parent / EPS Year

- Profit Attributable to Owners of the Parent / EPS Quarter

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast for Fiscal Year Ending March 31, 2024

- Forecast for Business Segment

- Management Policy & Business Strategy

- Summary of Fiscal Year ended 3/23

- Key Points of FY3/24 Forecast

- Long-term Trend of Sales and OP

- Mid-term Business Plan

- Launch pad to Accelerate Natural Growth Securing Mid-term Business Plan (1)

- Launch pad to Accelerate Natural Growth Securing Mid-term Business Plan (2)

- "INTEGRATION Products" to Accelerate Future Growth

- Precision Technologies (PT) Targets

- Growth Potential of Bearing Business

- Motor, Lighting & Sensing (MLS) Targets

- Semiconductors & Electronics (SE) Targets

- Analog Semiconductor Business Update

- Access Solutions (AS) Targets

- E (Environment) Environmental Initiatives

- S (Social) the Opening of Tokyo X Tech Garden

- G (Governance) New Management Structure

- Dividends

- Forward-looking Statements

- Reference

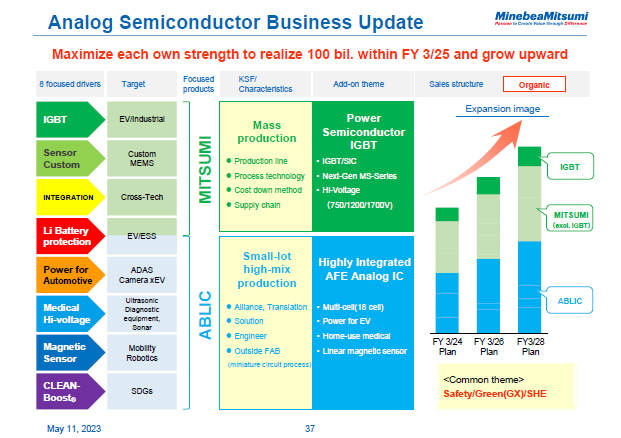

Today's highlight is that analog semiconductors are going to be our big driver going forward. In addition to INTEGRATION products, we've clarified the responsibilities and product categories of MITSUMI and ABLIC and formulated strategies for each.

First, MITSUMI will be responsible for power semiconductors, IGBT, and SiC devices, which are suitable for mass production and sales. This will enable Mitsumi semiconductors to grow even bigger.

ABLIC, which has always been good at high-mix low-volume manufacturing, has recently acquired SSC, a design house with famous semiconductor designers. This move has enabled ABLIC to add highly integrated analog front end (AFE) circuits to its drivers. Various sensors are at work while a car is running. Many of these sensors use highly integrated AFE circuits that instantly convert analog signals into digital signals, which are sent to the CPU in the back.

We should be able to generate sales of 70 billion yen with highly integrated AFE circuits alone by 2030.

We've been getting positive feedback from customers for our analog semiconductors. They will most likely be the next key product after bearings. Both are Rice of Industry.

Although we are looking to mass produce these products, we don't intend to compete directly with the industry giants. As in the past, we will continue to follow our global niche top strategy, which is to make products that leverage our unique characteristic and sell them at a fair margin to customers who appreciate them.

37page (total 47pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.