Presentation Transcripts

Latest Update : June 6, 2023

Back to Financial Results (FY3/2023)

Investor Meeting Presentation for FY 3/2023 held on May 11, 2023

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales, Operating Income / Margin

- Increase / Decrease & Special Factors of Full Year OP

- Net Sales, Operating Income / Margin

- Improvement of Understandability by Changing Segment Names

- 4Q Actual: Differences from the Forecast as of February

- Machined Components / Precision Technologies (PT) Year

- Machined Components / Precision Technologies (PT) Quarter

- Electronic Devices & Components / Motor, Lighting & Sensing (MLS) Year

- Electronic Devices & Components / Motor, Lighting & Sensing (MLS) Quarter

- MITSUMI Business / Semiconductors & Electronics (SE) Year

- MITSUMI Business / Semiconductors & Electronics (SE) Quarter

- U-Shin Business / Access Solutions (AS) Year

- U-Shin Business / Access Solutions (AS) Quarter

- Profit Attributable to Owners of the Parent / EPS Year

- Profit Attributable to Owners of the Parent / EPS Quarter

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast for Fiscal Year Ending March 31, 2024

- Forecast for Business Segment

- Management Policy & Business Strategy

- Summary of Fiscal Year ended 3/23

- Key Points of FY3/24 Forecast

- Long-term Trend of Sales and OP

- Mid-term Business Plan

- Launch pad to Accelerate Natural Growth Securing Mid-term Business Plan (1)

- Launch pad to Accelerate Natural Growth Securing Mid-term Business Plan (2)

- "INTEGRATION Products" to Accelerate Future Growth

- Precision Technologies (PT) Targets

- Growth Potential of Bearing Business

- Motor, Lighting & Sensing (MLS) Targets

- Semiconductors & Electronics (SE) Targets

- Analog Semiconductor Business Update

- Access Solutions (AS) Targets

- E (Environment) Environmental Initiatives

- S (Social) the Opening of Tokyo X Tech Garden

- G (Governance) New Management Structure

- Dividends

- Forward-looking Statements

- Reference

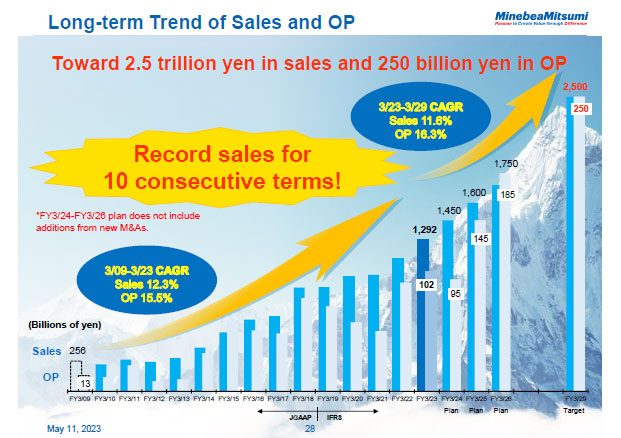

This graph shows sales and operating income since I became president, plus our latest three-year plan.

It didn't hit me at first, but I later realized that we have had record sales for the past ten years in a row.

Of course there are many factors behind this. We were able to achieve record highs in sales for ten consecutive years thanks to various factors, such as exchange rate fluctuations, product mix, supplied parts related to sub-core products, and changes in accounting standards, as well as 24 M&A deals. We can see that we have been on a clear growth path over the last 14 years.

When I became president, our company was smaller than Access Solutions is today, with sales of 230 billion yen. We would only make a 23 billion yen increase when sales grew 10%. If we do the same calculation for this year's sales of 1.3 trillion yen, we will generate an additional 130 billion yen, which will bring sales up to roughly the same as the 1.5 trillion yen in sales indicated in the three-year plan. We are now at the phase where the magnitude of the 10% sales increase is completely different from what it was in the past, and I believe our growth will accelerate even more in the future.

You may point out that operating income has not kept pace with sales, but the truth is, operating income will never grow if sales are not strong. For example, if we calculate the operating margin without factoring in the sales of supplied parts by customers, and the sales of Access Solutions which currently contributes little to profits, we can assume that the operating margin has already reached about 10%. Access Solutions is one of our future focus areas, and I'm sure that once this turns around, we will see a great return.

28page (total 47pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.