Presentation Transcripts

Latest Update : June 5, 2024

Back to Financial Results (FY3/2024)

Investor Meeting Presentation for FY 3/2024 held on May 10, 2024

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales, Operating Income / Margin Year

- Net Sales, Operating Income / Margin Quarter

- 4Q Actual: Differences from the Forecast as of February

- Precision Technologies (PT) Year

- Precision Technologies (PT) Quarter

- Motor, Lighting & Sensing (MLS) Year

- Motor, Lighting & Sensing (MLS) Quarter

- Semiconductors & Electronics (SE) Year

- Semiconductors & Electronics (SE) Quarter

- Access Solutions (AS) Year

- Access Solutions (AS) Quarter

- Profit Attributable to Owners of the Parent / EPS Year

- Profit Attributable to Owners of the Parent / EPS Quarter

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast

- Forecast for Business Segment

- Management Policy & Business Strategy

- Summary of FY3/24

- Key Points of FY3/25 Forecast (1)

- Key Points of FY3/25 Forecast (2)

- Long-term Trend of Sales and OP

- Mid-term Business Plan

- Precision Technologies (PT) Targets

- Ball Bearing Business Situation

- Actions to Strengthen PT Business through M&A

- Motor, Lighting & Sensing (MLS) Targets

- Growth Potential of Motor Business

- Semiconductors & Electronics (SE) Targets

- Growth Potential of Power Semiconductor Business (1)

- Growth Potential of Power Semiconductor Business (2)

- Access Solutions (AS) Targets

- Create value and introduce new INTEGRATION products through aggressive activities (1)

- Create value and introduce new INTEGRATION products through aggressive activities (2)

- New Plant (Second Plant in Cambodia) to be Established

- Accelerating Carbon Neutral

- Dividends

- Forward-looking Statements

- Reference

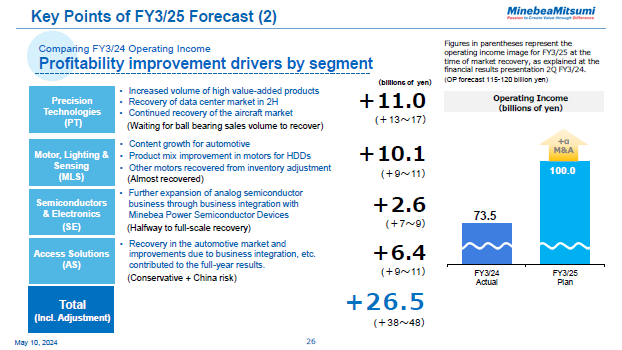

In this table, the image of operating income for the fiscal year ending March 31, 2025, assuming market recovery, presented at the 2Q investor meeting for the fiscal year ended March 31, 2024 of 77 billion yen operating income target is shown in brackets.

In addition, the bold figure represents a segment-by-segment comparison with the conservatively assumed operating income for the fiscal year ending March 31, 2025 as of the 4Q of the fiscal year ended March 31, 2024.

Consolidated total is assumed to be +26.5 billion yen.

For example, we assume +11.0 billion yen for Precision Technologies (PT), compared to the assumption of +13.0-17.0 billion yen (at 2Q of the fiscal year ended March 31, 2024). We originally had a view that various fields including data centers will recover and if we absorb the fixed cost, we will attain +13.0-17.0 billion yen. However, the volume has not yet recovered as much as we expected, and we feel that the outlook has changed from rainy to cloudy.

Motor Lighting & Sensing (MLS) is targeting 22 billion yen (+10.1 billion yen) in the fiscal year ending March 31, 2025, which is in the range of +9 to 11 billion yen assumption (at 2Q of the fiscal year ended March 31, 2024). Therefore, we believe that the recovery is almost complete.

Semiconductors & Electronics (SE) targets only +2.6 billion yen against the assumption of +7 to 9 billion yen (at 2Q of the fiscal year ended March 31, 2024), which means that a full recovery, especially in semiconductors, is still a ways off.

Access Solutions (AS) was assumed to be +9.0-11.0 billion yen (at 2Q of the fiscal year ended March 31, 2024). We are now targeting 17 billion yen (+6.4 billion yen from the fiscal year ended March 31, 2024), compared with our previous target of 20 billion yen (+9.4 billion yen from the fiscal year ended March 31, 2024) for the fiscal year ending March 31, 2025. One of the reasons for the decrease is that this is a conservative assumption, and the other is that the Chinese market, especially for EVs, is not doing very well.

26page (total 58pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.