Dividend/Share Repurchase

Latest Update : Nov.6, 2025

Dividend

Dividend Policy

Sharing profits with our Group's shareholders is first priority for MinebeaMitsumi. That is why its basic dividend policy gives priority to enhancing equity efficiency and improving returns to our shareholders. Dividends, while reflecting performance, are determined in light of the overall business environment and with an eye to maintaining a stable and continuous distribution of profits.

Based on the basic policy above, we will provide an interim dividend of 25 yen per share. The year-end dividend is also planned to be 25 yen, but we will determine the dividend payout ratio of around 30% on a consolidated basis, in light of the overall business environment.

Record Date and Date of Dividend Payment

| Interim dividend | Year-end dividend | |

|---|---|---|

| Record date (to be eligible to receive a dividend) | September 30 | March 31 |

| Date of dividend payment | December | June |

Transition of Dividend per Share

| Fiscal year (total) | Interim dividend | Year-end dividend | |

|---|---|---|---|

| 80th Business Term ending March 31, 2026 | TBD | 25.0 yen | TBD |

| 79th Business Term ended March 31, 2025 | 45.0 yen | 20.0 yen | 25.0 yen |

| 78th Business Term ended March 31, 2024 | 40.0 yen | 20.0 yen | 20.0 yen |

| 77th Business Term ended March 31, 2023 | 40.0 yen | 20.0 yen | 20.0 yen |

| 76th Business Term ended March 31, 2022 | 36.0 yen | 18.0 yen | 18.0 yen |

| 75th Business Term ended March 31, 2021 | 36.0 yen * | 14.0 yen | 22.0 yen * |

| 74th Business Term ended March 31, 2020 | 28.0 yen | 14.0 yen | 14.0 yen |

| 73rd Business Term ended March 31, 2019 | 28.0 yen | 14.0 yen | 14.0 yen |

| 72nd Business Term ended March 31, 2018 | 26.0 yen | 13.0 yen | 13.0 yen |

| 71st Business Term ended March 31, 2017 | 14.0 yen | 7.0 yen | 7.0 yen |

* For the fiscal year ending March 31, 2026, we will decide with a target dividend payout ratio of around 30%.

* Detail of year-end dividend as of March 31, 2021: Ordinary dividend of 14 yen per share, Commemorative dividend of 8 yen per share.

* The above data is for the past 10 years.

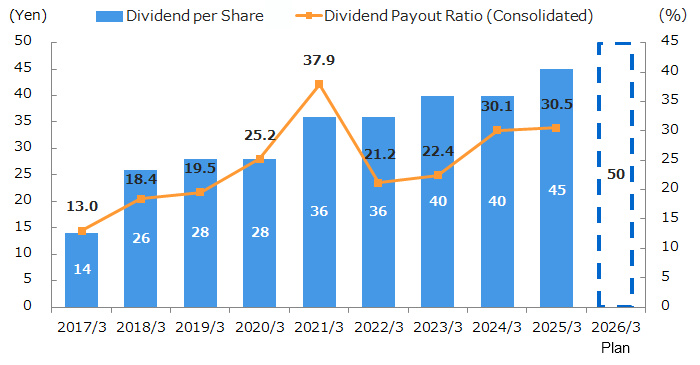

Transition of Dividend per Share and Dividend Payout Ratio

* MinebeaMitsumi has adopted International Financial Reporting Standards (IFRS) from the 1Q of FY3/2019.

* Detail of year-end dividend as of March 31, 2021: Ordinary dividend of 14 yen per share, Commemorative dividend of 8 yen per share.

Stock Split

No stock splits have during the past ten years.

Share Repurchase

To make it possible to carry out an agile capital management policy in response to changes in the business environment, we have repurchased our own shares shown below.

Results

| Period of Share Buyback | Method of Repurchase | Aggregate Number of Shares Repurchased (Thousand of shares) |

Aggregate Amount of Repurchase (Thousand of yen) |

Material |

|---|---|---|---|---|

| August 21, 2024 - November 6, 2024 |

Purchased on the Tokyo Stock Exchange | 2,800 | 7,778,606 | Notice regarding the Status of Own Shares Repurchase and Completion of Repurchase |

| August 7, 2023 - October 27, 2023 |

Purchased on the Tokyo Stock Exchange | 4,000 | 9,643,585 | Notice regarding the Status of Own Shares Repurchase and Completion of Repurchase |

| February 6, 2023 - March 16, 2023 |

Purchased on the Tokyo Stock Exchange | 4,184 | 9,999,974 | Notice regarding the Status of Own Shares Repurchase and Completion of Repurchase |

| August 5, 2021 - September 7, 2021 |

Purchased on the Tokyo Stock Exchange | 3,000 | 8,640,890 | Notice regarding the Status of Own Shares Repurchase and Completion of Repurchase |

| February 8, 2021 - April 30, 2021 |

Purchased on the Tokyo Stock Exchange | 2,497 | 6,774,034 | Notice regarding the Status of Own Shares Repurchase and Completion of Repurchase |

| May 9, 2019 - February 27, 2020 |

Purchased on the Tokyo Stock Exchange | 6,724 | 14,999,833 | Notice regarding the Repurchase Status of Own Shares and Completion of Repurchase |

| November 21 - December 17, 2018 |

Purchased on the Tokyo Stock Exchange | 6,300 | 10,631,779 | Notice regarding the Repurchase Status of Own Shares and Completion of Repurchase |

| February 14 - September 22, 2017 |

Purchased on the Tokyo Stock Exchange | 4,658 | 8,351,607 | Notice regarding Repurchase of Own Shares and Completion of Repurchase |

| June 17, 2016 | Private transaction | Convertible bonds worth 20,157 | 13,896,283 | Announcement of Purchase of the Convertible Bonds with Stock Acquisition Rights |

| May 23 - June 20, 2011 | Purchased on the Tokyo Stock Exchange | 5,000 | 2,008,793 | Notice regarding Status and Completion of Repurchase of Own Shares |

| February 3 - 8, 2010 | Purchased on the Tokyo Stock Exchange | 5,000 | 2,465,904 | Notice regarding Result and Completion of Repurchase of Own Shares |

| November 4 - 12, 2008 | Purchased on the Tokyo Stock Exchange | 10,000 | 3,148,918 | Notice regarding Result and Completion of Repurchase of Own Shares |

Shareholder Special Benefit Plan

We do not have a shareholder special benefit plan.