Presentation Transcripts

Latest Update : June 2, 2021

Back to Financial Results (FY3/2021)

Investor Meeting Presentation for FY 3/2021 held on May 7, 2021

- Cove

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales, Operating Income/margin Year

- Net Sales, Operating Income/margin Quarter

- 4Q Actual: Differences from the Forecast as of February

- Machined Components Year

- Machined Components Quarter

- Electronic Devices & Components Year

- Electronic Devices & Components Quarter

- Mitsumi Business Year

- Mitsumi Business Quarter

- U-Shin Business Year

- U-Shin Business Quarter

- Profit attributable to owners of the parent / EPS Year

- Profit attributable to owners of the parent / EPS Quarter

- Inventory

- Net interest-bearing debt / Free cash flow

- Forecast for Fiscal Year Ending March 31, 2022

- Forecast for Business Segment

- Changes of Business Segment

- Forecast for Business Segment (Adjusted)

- Management Policy & Business Strategy

- Summary of Fiscal Year ended 3/21

- Summary of Fiscal Year ending 3/22 Plan

- Mid-term Business Plan Targets

- Machined Components Targets

- Electronic Devices and Comp. (1) Targets

- Electronic Devices and Comp. (2) Motors

- Mitsumi Business (1) Targets

- Mitsumi Business (2) Optical Devices

- Mitsumi Business (3) Analog Semiconductors

- U-Shin Business Targets

- Construction of New Multi-purpose Factory

- Mission as CEO: Looking Back on My Tenure So Far

- Net Sales and Market Capitalization

- Path to 100 billion yen in operating income

- Mission as CEO: Looking Back on My Tenure So Far

- Laying the New Foundation for 100th Anniversary (1)

- Laying the New Foundation for 100th Anniversary (2)

- 70th Anniversary Dividend

- ESG Topics

- Forward-looking Statements

- Reference

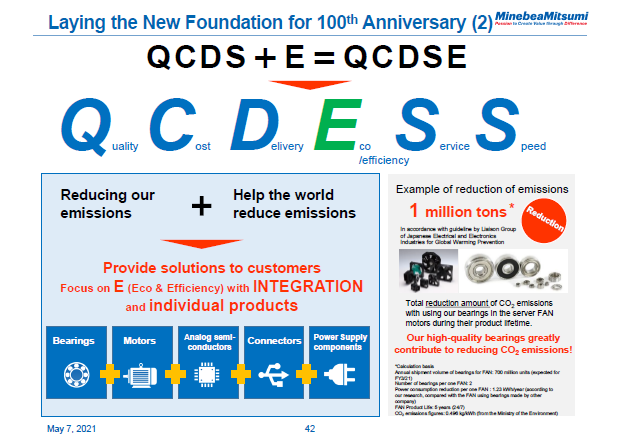

This is our other new strategy called QCDESS, which is an acronym combining QCDS with E and S.

I believe that achieving carbon neutrality is a must for humanity. How we address carbon neutrality is very important for our company as well. Products that do not contribute to carbon neutrality should eventually be driven out of the market.

Taking bearings as an example, we will work to dramatically improve their precision to differentiate ourselves. If we can make the conventional tolerance of 0.02 microns about three times smaller to provide better precision, this will further reduce the amount of energy required to run the motor. We will work on these initiatives for both bearing and analog semiconductor technologies.

Once we have realized this goal, our products will be much more competitive. This growth strategy will enable us to sell not only motors but also bearings and semiconductors to external customers. This will be our focus moving forward.

I'll give you more details and data on this when we announce our financial results in November.

42page (total 49pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.