Presentation Transcripts

Latest Update : Dec.24, 2024

Back to Financial Results (FY3/2025)

Investor Meeting Presentation for 2Q FY 3/2025 held on November 6, 2024

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results for 2Q

- Summary of Consolidated Business Results for 1H

- Net Sales, Operating Income / Margin

- 2Q Actual: Differences from the Forecast as of August

- Precision Technologies (PT)

- Motor, Lighting & Sensing (MLS)

- Semiconductors & Electronics (SE)

- Access Solutions (AS)

- Profit Attributable to Owners of the Parent / EPS

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast

- Forecast for Business Segment

- Full-year forecast: Differences from the Forecast as of August

- Business Update & Management Strategy

- Today's Points

- Forecast for FY 3/25

- Precision Technologies (PT) Update

- New Pursat Plant (second plant in Cambodia)

- Motor Lighting & Sensing (MLS) Update

- Bed Sensor System

- Semiconductors & Electronics (SE) Update

- Measures to strengthen analog semiconductor business through business acquisition

- Access Solutions (AS) Update

- Progress of INTEGRATED Products

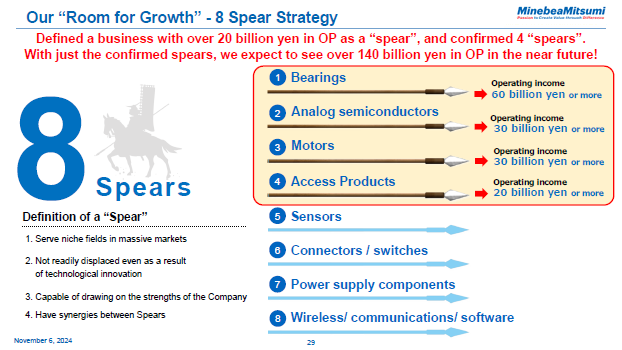

- Our "Room for Growth" - 8 Spear Strategy

- Shareholders Return

- ESG Topics

- Forward-looking Statements

- Reference

Looking back at the time when we were aiming for sales of 1 trillion yen, there was a period of about three years when we were slightly short of our goal, but this fiscal year we are ready to reach for the level of 1.5 trillion yen. There seems to be a wall for operating income at 100 billion yen, but I believe it is a glass wall.

As mentioned earlier, if bearings can achieve an operating income of 56 billion yen, 60 billion yen will be the next target. In analog semiconductors, even if the business environment is somewhat unfavorable this fiscal year, we expect 23-24 billion yen, and if the environment improves, we can aim for 30 billion yen. The motor business is expected to reach 27 billion yen this fiscal year, which means that the target of 30 billion yen is also in sight. Access is also aiming for 20 billion yen if high margin electronic components are added to the forecast of 17 billion yen for the current term. If we add the 20 billion yen from the sub-core business to this, total operating income will be 160 billion yen, and if we exclude head office expenses and business division expenses, we can expect to see a total of 130 billion yen.

29page (total 41pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.