Presentation Transcripts

Latest Update : Aug.26, 2022

Back to Financial Results (FY3/2023)

Investor Meeting Presentation for 1Q FY 3/2023 held on August 5, 2022

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results for 1Q

- Net Sales, Operating Income / Margin

- 1Q Actual: Differences from the Forecast as of May

- Machined Components

- Electronic Devices & Components

- MITSUMI Business

- U-Shin Business

- Profit Attributable to Owners of the Parent / EPS

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast for Fiscal Year Ending March 31, 2023

- Forecast for Business Segment

- Business Update & Management Strategy

- Today's Points

- Today's Points (2)

- 3 spears +1

- Growth strategy

- New M&A deals

- Commencement of TOB of HONDA TSUSHIN KOGYO CO., LTD

- Acquisition of All Shares of SUMIKO TEC CO., LTD.

- Solidify the Foundation as 8 Spear by Integrating 3 Companies

- Connectors' Future with Ultra High-Speed Communications

- Image of connector-related in-vehicle products after integration

- Solidify the Foundation as 8 spear by Integrating 3 Companies

- Acquisition of All Shares of Honda Lock Mfg. Co., Ltd.

- Strengthening the access products business via integration

- Expand automotive Tier1 business based on access products

- Strengthening the Access Products Business

- Name of New Tokyo Base and Shareholders Return, etc

- Forward-looking Statements

- Reference

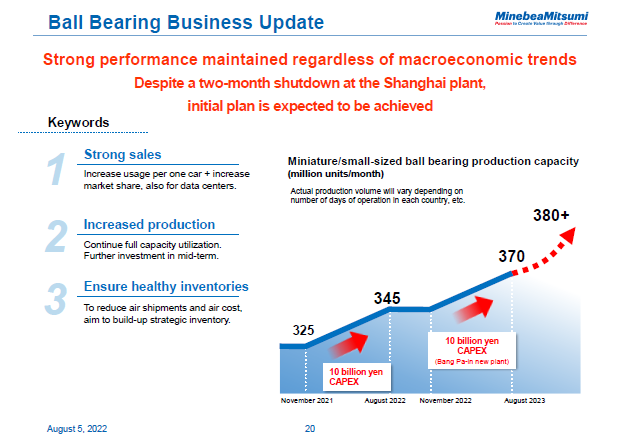

First of all, our ball bearing business is in very good shape. I have been told that sales of bearings for automotive applications grew about 14% last year and should increase by over 19% this year. Although the growth in automobile production is slowing, the number of bearings used per vehicle is increasing, and we believe that our market share is quickly rising. I think this is a stamp of approval from the automotive industry for our ability to always supply outstanding products.

While some have expressed concern about the slowdown in the data center market, the bottom line is that our bearings sales figures have not declined one bit. According to statistics on investments in property, plant and equipment in China this year, investments in real estate have indeed declined, but data communications investments are reported to have grown by about 20% in the first half of the current fiscal year. There is really nothing to worry about since we will be selling large quantities of fan motors and bearings as investments in data centers grow in China and elsewhere.

We've also seen a recovery in the aircraft industry, especially for Airbus.

While we expect to see some ups and downs this year, we believe the machined components business will remain strong and generate more than 50 billion yen in operating income. We've already made investments to increase production capacity for ball bearings by 5 million units, taking us from 365 million units to 370 million units. I believe that we can achieve an operating income of 60 billion yen, which is one of our goals for machined components, in a year or two.

20page (total 53pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.