Presentation Transcripts

Latest Update : Nov.30, 2021

Back to Financial Results (FY3/2022)

Investor Meeting Presentation for 2Q of FY3/2022 held on November 5, 2021

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results for 2Q

- Summary of Consolidated Business Results for 1H

- Net Sales, Operating Income/margin

- 2Q Actual: Differences from the Forecast as of August

- Machined Components

- Electronic Devices & Components

- Mitsumi Business

- U-Shin Business

- Profit attributable to owners of the parent / EPS

- Inventory

- Net interest-bearing debt / Free cash flow

- Forecast for Fiscal Year Ending March 31, 2022

- Forecast for Business Segment

- Business Update & Management Strategy

- FY3/22 Forecast Highlights (Revised upward)

- Machined Components (Prepare for giant leap)

- Electronic Devices and Components (Expand motors)

- Mitsumi Business (Aim at record high OP)

- U-Shin Business (Wait for the recovery of auto production)

- Estimate for next fiscal year (Aim ¥100bn OP)

- Key businesses driving mid-to long-term growth (Beyond 1,000)

- QCDESS and Environmental Load Reduction Activities

- (1) Toward carbon neutrality

- (2) Toward Realizing "MMI Beyond Zero"

- (2) Effort for "MMI Beyond Zero"

- Dividends

- Forward-looking Statements

- Reference

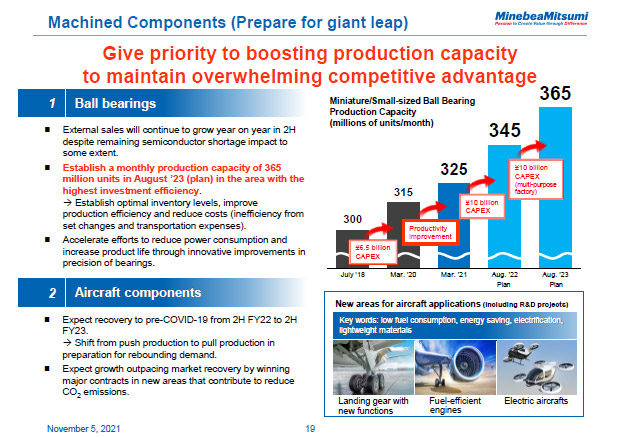

In the latter half, bearings were impacted by the semiconductor shortage, but with historically low inventory levels, every month there are still 100 million yen in air charges. This time around we hope to achieve sound growth by optimizing inventory. For that reason, we will come up with detailed criteria such as holding more inventory for those items that have a longer distribution lead time.

In regard to our road map for production capacity, our greatest achievement was increasing production by 10 million units, going from 315 million to 325 million units through productivity improvement. Machines will gradually be coming in from the 10.0 billion yen investment already discussed. However, these deliveries have also been pushed back due to the semiconductor shortage. We hope to somehow get all lines up and running by around August of next year to reach 345 million units. Furthermore, we hope to enhance our overwhelming competitiveness and supply capacity of ball bearings by increasing our production capacity to 365 million units with an additional investment of 10.0 billion yen.

As for aircraft components, we expect to return to pre-COVID-19 levels on a monthly basis between the latter half of next year and the first half of the year after next. One of our new businesses is the landing gear with new functions you can see on the left side of the photo. Normally, a special vehicle such as a truck is used to push the aircraft back, but in this undertaking, we put a motor in the wheels and motorized them. Lightweight ceramic bearings offering high efficiency rotation from our subsidiary CEROBEAR were used. This is a very exciting example.

19page (total 38pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.