Corporate Governance

Latest Update : Dec.8, 2025

Corporate Governance System

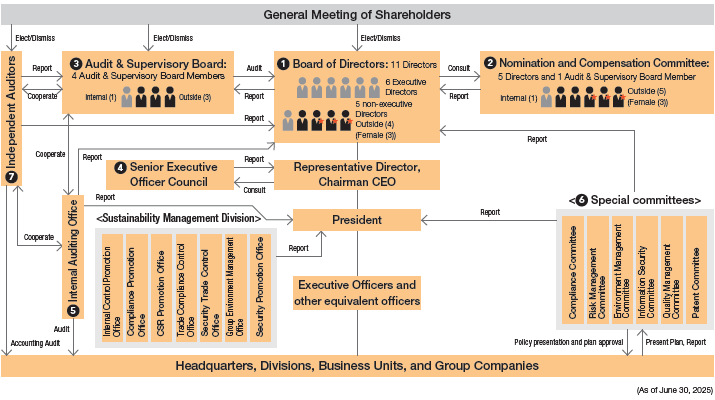

Diagram of Corporate Governance Structure

Corporate Governance Structure

| ① Board of Directors | The 11 directors (including 4 independent outside directors) make prompt and highly strategic decisions and supervise management at regular monthly meetings of the Board of Directors and extraordinary meetings held as necessary. Significant business matters related to our domestic and overseas Group Companies are reported to and resolved by the Board of Directors. |

|---|---|

| ② Nomination and Compensation Committee | This committee is established as an advisory body to the Board of Directors to improve transparency and objectivity in the process of nominating candidates for directors and determining their compensation. The chairperson of this committee is an independent Outside Director and at least half of the members are independent Outside Directors. |

| ③ Audit & Supervisory Board Meeting | The Ordinary Audit & Supervisory Board meetings are held once every month in principle and extraordinary meetings are held accordingly, to discuss and adequately analyze specific issues. In addition, quarterly meetings are held with the Representative Director, Chairman CEO and Outside Directors to exchange respective views. |

| ④ Senior Executive Officer Council | This Council serves as an advisory panel for the Representative Director, Chairman CEO. Matters related to business operations are discussed by the Senior Executive Officer Council in basically a monthly meeting or in extraordinary Senior Executive Officer Council when necessary. |

| ⑤ Internal Auditing Office | The Internal Auditing Office regularly audits the Group Companies. Internal audits are designed to correct nonconforming or inappropriate operational procedures and improve the quality and efficiency of operations in accordance with internal audit regulations. |

| ⑥ Special Committees | The Company has established committees for the purpose of monitoring and enhancing the effectiveness of governance regarding specific matters necessary for business operations, such as Compliance, Risk Management, Environmental Management, Information Security, Quality Management and Patents, etc. |

| ⑦ Independent Auditors | KPMG AZSA LLC carries out the Company's accounting audits pursuant to the audit service agreement it has concluded with the Company for the implementation of audits under the Companies Act and audits under the Financial Instruments and Exchange Act. In order to monitor the independence of the auditing firm with respect to accounting audits, the Company seeks the consent of the Audit & Supervisory Board regarding the details of the audit service agreement, etc. and the amount of compensation. |

Members of each institution (◎ is chairperson)

| Positions | Name | Board of Directors Meeting | Nomination and Compensation Committee | Senior Executive Officer Council | Audit & Supervisory Board |

|---|---|---|---|---|---|

| Representative Director, Chairman CEO |

Yoshihisa Kainuma | ◎ | ○ | ◎ | |

| Representative Director, Vice Chairman |

Shigeru Moribe | ○ | ○ | ||

| Director, President COO & CFO |

Katsuhiko Yoshida | ○ | ○ | ||

| Director, Vice President Executive Officer |

Ryozo Iwaya | ○ | ○ | ||

| Director, Senior Managing Executive Officer |

Satoshi Mizuma | ○ | ○ | ||

| Director, Managing Executive Officer |

Katsutoshi Suzuki | ○ | ○ | ||

| Director, (Non-Executive) | Takashi Matsuoka | ○ | |||

| Outside Director | Yuko Miyazaki | ○ | ◎ | ||

| Outside Director | Atsuko Matsumura | ○ | ○ | ||

| Outside Director | Yuko Haga | ○ | ○ | ||

| Outside Director | Hirofumi Katase | ○ | ○ | ||

| Standing Audit & Supervisory Board Member | Masahiro Tsukagoshi | ◎ | |||

| Standing Outside Audit & Supervisory Board Member | Hiroshi Yamamoto | ○ | |||

| Outside Audit & Supervisory Board Member | Shinichiro Shibasaki | ○ | ○ | ||

| Outside Audit & Supervisory Board Member | Makoto Hoshino | ○ | |||

| Others | ○*1 |

*1 The Senior Executive Officers Meeting is comprised of six Representative Directors and Executive Directors, as well as Managing Executive Officers and Executive Officers appointed by Representative Director, Chairman CEO.

Reasons for Adoption of Current Corporate Governance System

In addition to establishing a Board of Directors and an Audit & Supervisory Board as bodies under the Companies Act, the Company has established a Nomination and Compensation Committee and Senior Executive Officer Council as discretionary bodies to supplement those functions.

The Company has adopted this system because it achieves effective governance. It does this by the Board of Directors, including Outside Directors, overseeing business execution and making rapid and highly strategic management decisions while the Audit & Supervisory Board Members, including Outside Audit & Supervisory Board Members, audit the execution of the responsibilities of Directors from an objective and independent standpoint.

Main agenda items at Board of Directors meetings

Management strategy, M&A, Midterm Business Plan, Director compensation and nomination of officers, Reorganization and personnel transfers, Capital investment and financing, Risk management, Compliance, Next generation human resource development, Environment, Renewable energy, Issues based on effectiveness evaluation.

Disclosure of Summary of the Results on Analysis and Evaluation its Effectiveness as a whole

We periodically verify the members, agenda and operational status of the Board of Directors in terms of whether the entire Board of Directors is functioning appropriately. This is to ensure that the Board of Directors effectively fulfills its roles.

With this, we evaluated the effectiveness of the Board of Directors to extract issues and identify problems and strengths. Every Director and Audit & Supervisory Board Member undertakes a self-assessment with a written questionnaire with the involvement of a third party in March every year. The purpose of this is to look back at progress on improvements from the previous fiscal year and to discover important issues for the next fiscal year.

The summary of the FY2024 Board of Directors Effectiveness Evaluation results is as follows.

Summary of Evaluation Results

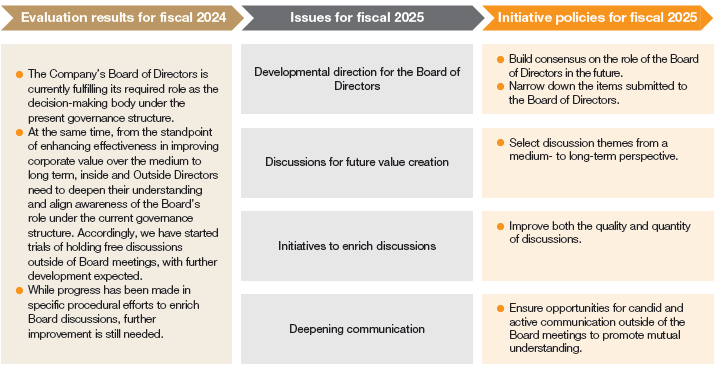

- The Company's Board of Directors is currently fulfilling its required role as the decision-making body under the institutional design.

- However, from the perspective of enhancing the Board's effectiveness to drive medium- to long-term corporate value growth, it is necessary for both internal and external directors to deepen their understanding and share a common recognition of the "role of the Board of Directors" under the current institutional design. To this end, the Board has begun experimenting with setting aside time for free discussion outside of formal Board meetings, and further developments in this area are anticipated.

- Regarding specific procedural initiatives to enrich Board discussions, while progress has been made, these efforts remain ongoing and require continued improvement.

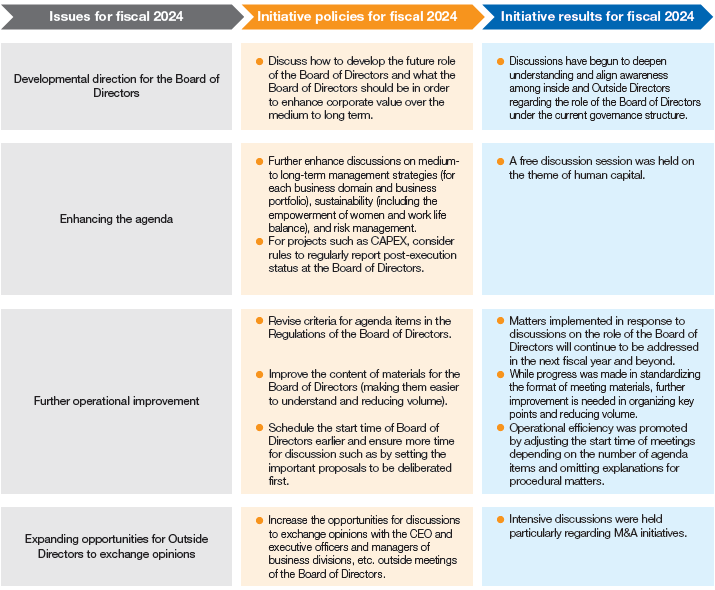

Issues and results of initiatives based on the evaluation of the effectiveness of the Board of Directors conducted in March 2024

Results of evaluation of the effectiveness of the Board of Directors conducted in March 2025, issues, and initiatives for the current fiscal year

Supporting System for Outside Directors and/or Outside Audit & Supervisory Board Members

Support for Outside Directors is basically handled by the Secretariat of the Board of Directors, but the relevant departments appropriately handle as necessary. With regard to Outside Audit & Supervisory Board Members, the Company strives to maintain close contact with full-time Audit & Supervisory Board Members and share information. In addition, the Company distributes materials and gives advance explanations on the necessary agenda items for the Board of Directors meetings in advance to Outside Directors and Outside Audit & Supervisory Board Members in order to ensure that they understand the details of the agenda and reported items as soon as possible.

Also, the Company establishes opportunities for visits to major business sites including overseas and explanations by members of these business sites for Outside Directors and Outside Audit & Supervisory Board Members in order for them to gather information about the Company's organization, business operations and business sites, etc.

Cooperation among Audit & Supervisory Board Members, Independent Auditors and Internal Audit Departments

The Audit & Supervisory Board periodically holds meetings with the Internal Auditing Office, listens to and given opinions on annual audit plans and their objectives, etc., and receives reports about all internal audit results. In implementing audits, the Audit & Supervisory Board holds prior discussions on important auditing points and other matters, and joins and observes internal audits where necessary. In addition, the Audit & Supervisory Board receives explanations of the audit structure, audit plan, and audit implementation status from KPMG AZSA LLC, the Company's independent auditor, as well as carries out information sharing and information exchanges, etc. It also joins accounting audits conducted of domestic business sites and Group Companies, through which it regularly checks the suitability of the auditing method.

Changes in governance-related indicators

| Organizational Body |

Unit | 77th FY2022 (Apr.2022-Mar.2023) |

78th FY2023 (Apr.2023-Mar.2024) |

79th FY2024 (Apr.2024-Mar.2025) |

|

|---|---|---|---|---|---|

| Board of Directos Meeting | Number of Directors | persons | 11 | 12 | 12 |

| Number of Executive Directors | persons | 6 | 7 | 7 | |

| Number of Outside Directors | persons | 5 | 5 | 4 | |

| Number of female Directors | persons | 3 | 3 | 3 | |

| Average age of Directors | years old | 64.8 | 64.9 | 65.9 | |

| Number of Board of Directors Meeting held | times | 16 | 12 | 12 | |

| Attendace rate at Board of Directors Meeting | % | 100 | 100 | 99.3 | |

| Attendace rate of Outside Directors | % | 100 | 100 | 100 | |

| Nomination and Compensation Committee | Number of members | persons | 6 | 6 | 6 |

| Number of outside members | persons | 5 | 5 | 5 | |

| Average age of members | years old | 66.5 | 67.5 | 68.5 | |

| Number of Committee held | times | 6 | 7 | 3 | |

| Attendace rate at Committee | % | 97.6 | 95.2 | 94.4 | |

| Attendace rate of Outside members | % | 100 | 100 | 100 | |

| Audit & Supervisory Board Meeting | Number of Audit & Supervisory Board members | persons | 4 | 4 | 4 |

| Number of Outside Audit & Supervisory Board members | persons | 3 | 3 | 3 | |

| Average age of Audit & Supervisory Board members | years old | 62.8 | 64.0 | 65.0 | |

| Number of Audit & Supervisory Board Meeting held | times | 14 | 15 | 14 | |

| Attendace rate at Audit & Supervisory Board Meeting | % | 100 | 100 | 100 | |

| Attendace rate of Outside Audit & Supervisory Board Meeting members | % | 100 | 100 | 100 |

* The above figures are as of each fiscal year-end. Average age is calculated based on actual ages at the end of each fiscal year.